Key Takeaways:

-Tariffs and supply chain disruptions disproportionately harm small businesses that have neither the systems nor the negotiating power to adapt to volatile import costs.

-Small businesses have thinner margins than larger corporations, making them unable to weather prolonged impacts from import costs and uncertainty.

-Small businesses face a tradeoff between absorbing losses or raising prices, both of which cause significant financial damage and increase the risk of bankruptcy.

Tariffs Have Driven a Significant Rise in Small-Business Bankruptcies

2025 has seen approximately 23,000 small-business bankruptcies filed—a 13.1 percent increase over last year and a clear indicator that financial conditions for American small businesses have significantly worsened. A primary driving force behind the business failures is the variety of tariffs imposed by the Trump Administration throughout the year, which significantly raised import costs on everything from raw materials to lumber to auto parts.

Tariffs are estimated to have cost small businesses 202 billion dollars this year, almost 900 thousand dollars per company per year. High import duties because of tariffs have caused suppliers to pass costs to small businesses, yet since tariff implementation, many small businesses have been hesitant to raise prices and further pass costs down to consumers.

Small Businesses Are Disproportionately Vulnerable to Tariffs

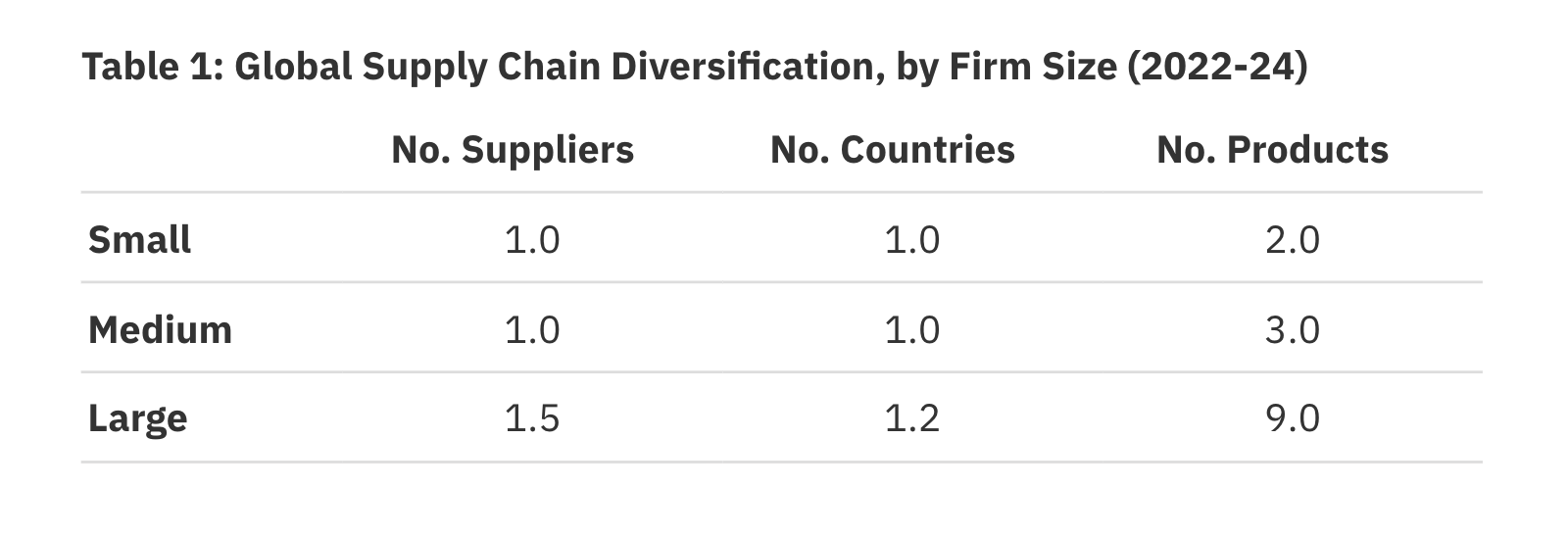

One of the most significant differences between small businesses and large corporations is that while large corporations often import and manufacture products through complex global supply chains and suppliers across multiple countries, the majority of US small businesses rely on a single importer for goods.

Data Obtained from Federal Reserve Bank of Atlanta, LINK

Without being diversified across multiple suppliers, small businesses are disproportionately vulnerable to the industry-specific tariffs seen this year and have fewer opportunities to reroute production or import to countries with lower import duties—a privilege that larger corporations with multinational supply chains are afforded. Small-business surveys show that 58% anticipate supply delays and 49% struggle to find new suppliers. Additionally, because smaller businesses comprise a smaller customer share and sale volume of large suppliers, they have less negotiating power to cut deals for delayed tariff passthrough and are forced to internalize import duties.

Small Businesses Can’t Weather Prolonged Tariff-Driven Losses

Larger corporations’ heightened ability to adapt to supply chain disruptions isn’t the only way that they are more resilient to tariffs: small businesses operate with significantly thinner margins than large corporations and also possess much weaker lines of credit and cash balances in comparison to large corporations, who often have larger cash balances and banking partnerships. For those reasons, small businesses have significantly less resilience to prolonged costs from volatility and uncertainty, with 39% of small businesses only having enough cash to support their business for a month during disruptions or uncertainty.

The lack of safety net means that small businesses are backed against the wall when facing the prospect of raising prices. While some were able to temporarily delay cost increases by front-loading (purchasing larger volumes of imported goods before tariffs came into effect), they still face a short time window to raise prices when compared to durable, larger-scale corporations. Within the US economy, this drives a price advantage for larger corporations, whose products can function as cheaper substitutes for those of small businesses and who can gradually raise prices. While significantly impacted auto manufacturers such as Toyota and GM have the ability to absorb multi-billion dollar losses without implementing significantly higher pricing, surveys of small businesses reveal that 71% plan to raise prices to offset the Trump tariffs.

Economic Uncertainty Is Driving Lose-Lose Tradeoffs for Small Businesses

The structural inequalities drive a lose-lose tradeoff for small firms: they can either continue to absorb losses or raise prices sharply and earlier than bigger companies, which economically reduces demands for their products and strains customer relationships. In either case, they incur losses. Although some companies have used strategies to partially avoid tariff-related losses, such as discontinuing products that can’t be sourced domestically, singular-supplier dynamics and increased costs are a problem that can’t be fully averted for many businesses.

To make matters more complex, small businesses are facing record levels of uncertainty, as the punitive and unpredictable tariffs enacted this year have challenged typical business practices of cutting long-lasting wholesale supply deals. Without knowing if tariffs will be suddenly implemented or lifted, small businesses have faced low clarity and confidence regarding supply-level business decisions—survey responses find that tariff-related uncertainty has cost small businesses on average 4% of their revenue. Chad Coulter, CEO of Biscuit Belly, explains it succinctly: “Businesses can’t adapt when they don’t know what’s coming next.”

The Bottom Line

The second-term Trump administration’s tariffs have wreaked havoc on small businesses, which are disproportionately impacted by supply chain disruptions and prolonged economic uncertainty. While tariffs were enacted with the goal of localizing economic activity, small businesses face increased difficulty surviving transitional tariff headwinds compared to large corporations. The rapidly rising bankruptcies for small businesses, which are a crucial component of the US economy and a major employer of American people, due to tariffs raise questions about the effectiveness of tariff policy for the general welfare of consumers and the stability of smaller domestic companies.