Key Takeaways:

-Tariffs in 2018 lowered net manufacturing employment, and rippling tariff costs to other sectors had negative impacts on employment.

-Current tariffs on steel have driven similar layoffs in manufacturing.

-Tariff-driven increases in unemployment have mortality consequences for working-class Americans.

Tariffs Have Driven Declines in Manufacturing Employment

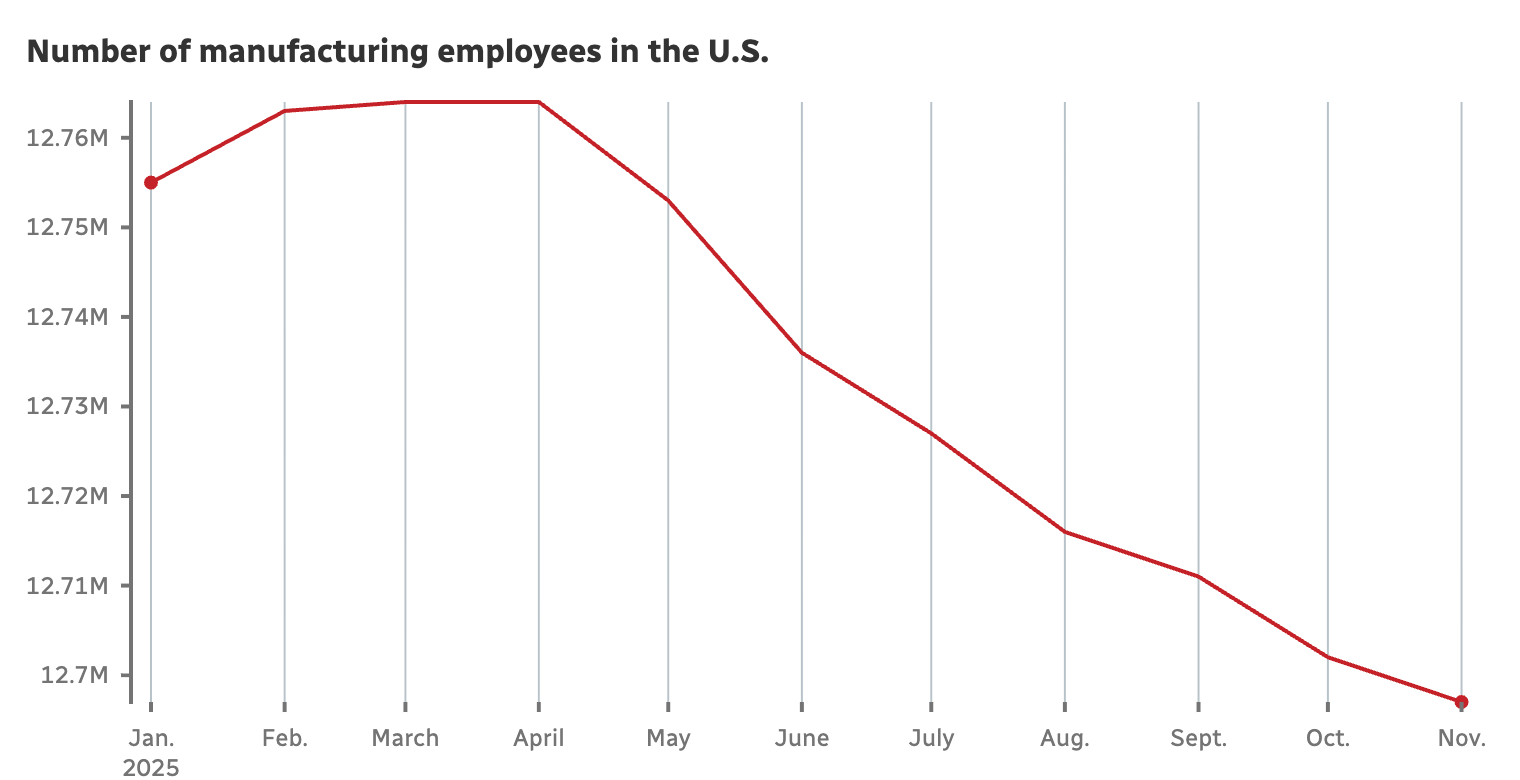

One of the driving forces behind the implementation of tariffs by the second-term Trump administration was heightened unemployment rates in the US. However, tariff policy proved to be a particularly blunt tool in order to achieve the employment growth promised to American workers. In fact, after a relative plateau in manufacturing jobs following initial tariffs implemented in February, manufacturing employment steeply dropped following April 2nd “Liberation Day” tariffs. The most recent data shows that manufacturing jobs have dropped by approximately 69,000 since then.

US Bureau of Labor Statistics, FRED.

The decline in manufacturing employment can be attributed to several areas of weakness in the US economy, but peer-reviewed research on past tariffs and current economic analysis point to two major pain points. The first is uncertainty: the sweeping tariffs announced on “Liberation Day” and punitive tariffs implemented and withdrawn throughout 2025 contributed to unprecedented levels of economic policy uncertainty.

The Economic Uncertainty Index, PU

Macro-uncertainty significantly impacts the economy, constraining both consumer spending and business investment. In the manufacturing sector specifically, tariff-related uncertainty has led to consequences in the supply, employment, and investment sides of manufacturing. In a survey of business leaders in manufacturing and supply chains led by the National Foreign Trade Council, nearly half of the respondents said tariffs are affecting workforce-related decisions.

The second driver of manufacturing layoffs is reduced manufacturing investment. In the same survey, 75% of respondents reported that tariff-related uncertainty is constraining US investment. Under the administration’s indiscriminate tariff threats to both political allies and enemies and it’s volatile implementation and rollbacks of agriculture and upholstery tariffs, manufacturing firms have been unable to confidently make business investments such as wholesale orders without knowing for certain how or when the next supply chain disruptions will impact their margins. Foreign investors are faced with the same dilemma: how can one confidently invest in a manufacturing business without knowing when sudden tariff policy could threaten growth or even profitability?

Furthermore, from a policymaking perspective, the tariffs implemented on raw materials are a counterintuitive way to increase manufacturing employment. Heightened costs of metals result in increased costs of production for several of the sectors within manufacturing, especially those that use steel and aluminum as primary inputs. In fact, economic research on the 2018 tariff war, when similar tariffs were enacted on steel, has yielded the same conclusion: a Federal Reserve study found that the manufacturing industry saw a net-negative effect on employment because the benefits of import protection were outweighed by higher input costs. Results seen in the last trade war and the current employment trends in manufacturing deliver a clear message: in terms of employment, the cons of tariffs outweigh the pros.

Tariffs Have Historically Driven Declines in Aggregate US Employment

Zooming out of the manufacturing sector, tariff-impacted industries such as agriculture, automotive repair, and retail are unlikely to see increases in employment due to drops in both revenue and business investment. In regards to the impact on the aggregate American job market, research from the Journal of International Economics finds that tariffs under the first-term Trump administration drove a combined effect of 175,000 fewer job postings in 2018, or 0.6 percent of the US total, entirely attributed to higher costs of inputs due to tariffs. Aligning with this data, the Yale Budget Lab finds that tariffs will cause a 0.6 percentage point increase in US unemployment by the end of 2026.

Tariff-driven Unemployment Has Serious Consequences for Poverty

Measuring changes of employment in terms of a fraction of a percent can conceal the real impacts that a marginal decrease in total jobs can cause. With 35% of Americans living paycheck to paycheck, more than a third of American people can’t afford to lose employment without making significant financial tradeoffs in their lives or being threatened with losing the necessities that make up the majority of their annual expenditures.

Among working-class Americans, research shows that a one percent decline in employment rates causes a 6% increase in the likelihood of death. The impacts are likely even more severe for low-income Americans, as data shows that a decade ago essential goods and services cost over 80% of their take-home income, and steeply increasing costs of living combined with flat income have likely exacerbated the issue since then.

Data Obtained from The Hamilton Project, LINK.

While higher-income Americans have financial safety nets for prolonged unemployment, tariff disruptions to the labor market can be financially ruinous for working-class Americans and statistically life-threatening.

The Bottom Line

Economic policy almost always has a direct or indirect impact on poverty. Sweeping tariffs implemented with the goal of reshoring manufacturing will have significant consequences for the US labor market, which are associated with heightened likelihoods of death across the working class. The manufacturing employment declines seen throughout the last year align with peer-reviewed economic research on labor market impacts of the 2018-19 trade war, in which similar tariffs on steel yielded almost identical results.

The reiteration of a previously failed economic strategy with the goal of improving domestic manufacturing and aggregate employment should be of concern to economists, policymakers, and the working class and lower-income households. With research showing that free trade leads to decreased unemployment and increased welfare for consumers, it’s critical that the US government employ a people-first approach to policy that takes into account the possibly life-or-death impacts of blunt trade policy on working-class Americans.

If you’re interested in learning more about how tariffs have affected consumer conditions, read our other posts about how tariffs are destroying American farmers here